Now that we’ve been able to move past the global pandemic that has occupied our global attention for going on three years, we can bring our focus back to another crisis that is encompassing our entire planet; climate change.

Although it may not have been as much on the forefront of our collective minds, climate change is certainly not a problem that has gone away, and consumers are still making changes in their purchasing habits to support companies that are operating with more sustainability.

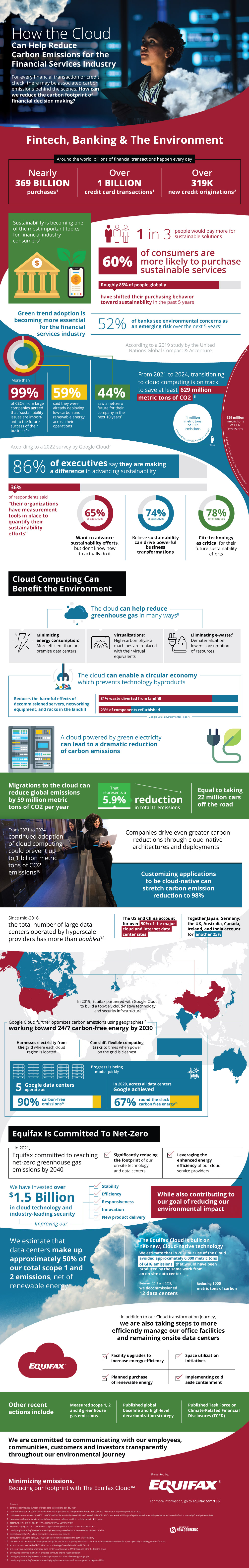

In fact, 85% of consumers across the globe have made changes in their consumerism over the past 5 years, in an effort to decrease their personal carbon footprint.

For this and many other reasons, big markets, such as the finance industry, must and are taking note and making concerted efforts to change how they do business.

There are billions of purchases, credit card transactions, and thousands of new credit organizations every single day, and each of these usually causes CO2 emissions of some kind. However, there are alternative ways to make these transactions environmentally friendly.

Within three years, transitioning to cloud computing in the finance industry, will save 629 million metric tons of CO2 emissions. Transferring processes to the cloud should be on the top of every finance executives priority list when it comes to creating a sustainable industry.