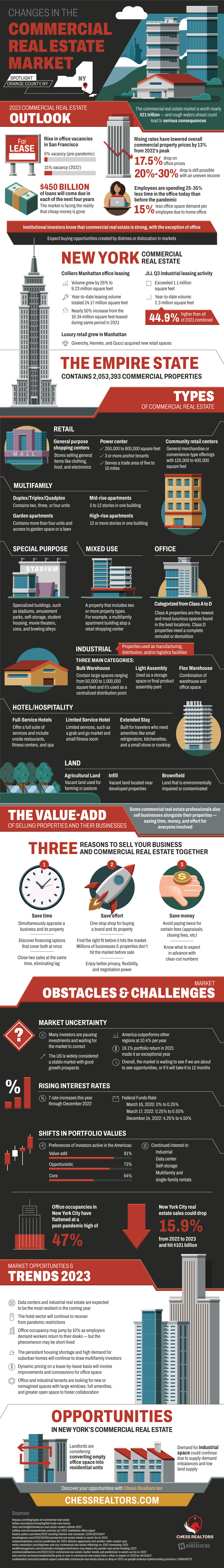

The commercial real estate market is worth over a whopping $20 trillion, but lower office space demand and rising interest rates is about to cause rough waters for this market. The pandemic and the rise of remote work has caused many to need less office space or even none at all. Employees are spending up to 35% less time in the office today as compared to before the pandemic causing 15% less office space demand per employee. Office vacancies have more than doubled in the San Francisco area since before the pandemic alongside a 17.5% drop in office prices across the country.

Uncertain times lead to some investors getting scared which leaves others able to grab hold of new opportunities. Institutional investors know that while office spaces are weak, commercial real estate as a whole is still very strong. Many commercial real estate professionals also take advantage of the benefits of selling a business and their properties at the same time. Selling commercial real estate alongside a business helps avoid latency between sales and dodges extra fees and added complexity.

Learn more about the future of the commercial real estate market and the benefits of selling a business and property together here.

Source: ChessRealtors.com